When it comes to cannabis, San Jacinto's business is booming

The San Jacinto City Council will vote Tuesday on cannabis tax rates as city data shows the industry generated more than $56.6 million in gross receipts over the past three years.

The council must decide whether to maintain the current 10% tax rate on cannabis businesses, return to the previous 15% rate, or choose a new rate below 15%. Any changes would take effect April 1, 2025.

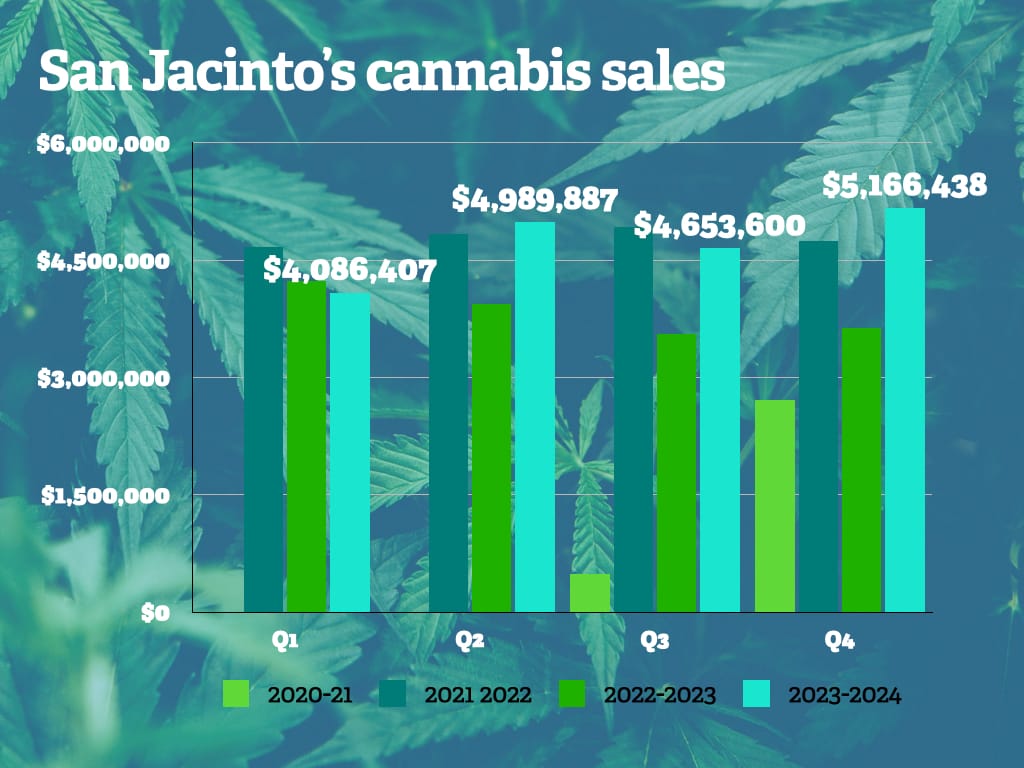

Cannabis sales reached their highest level in the most recent quarter, with $5.1 million in revenue for the fourth quarter of fiscal year 2023-2024. Retail cannabis taxes now make up 7.04% of the city's General Fund recurring revenue.

City officials say maintaining the current 10% rate would create a $463,241 revenue shortfall for fiscal year 2024-2025, representing a 16.66% drop from original projections. This option would lead to an annual reduction of $944,817 compared to fiscal year 2023-2024 baseline revenues.

Returning to the 15% rate would result in a smaller shortfall of $231,620. A third option would set the rate below 15%, with revenue reductions proportional to the rate decrease.

The tax debate follows steady growth in cannabis revenue since late 2020. Quarterly earnings started at $491,140 in the third quarter of fiscal year 2020-2021 before climbing to consistent levels between $4 million and $5 million by fiscal year 2023-2024.

San Jacinto's cannabis tax structure stems from Measure AA, approved by voters in 2016. Unlike state cannabis taxes, the city's tax applies to businesses rather than consumers. Cannabis sales also face an 8.75% state sales tax, with 2% returning to the city.

The council's decision will affect both microbusinesses and dispensaries. The city recently shifted from strict licensing limits to letting market demand determine the number of dispensaries.

State law requires cannabis retailers to collect a separate 15% excise tax from consumers, implemented in 2018. Recent legislation under SB 1059 clarified how cities can define gross receipts for local taxation, though San Jacinto's practices already comply with these requirements.